Mastering Your Debt-to-Income Ratio: Understanding and Improvement Strategies

Grasping the Basics of Debt-to-Income Ratio

Imagine you're planning a journey through uncharted financial territories. Your debt-to-income (DTI) ratio is the compass that guides you, a crucial number lenders use to gauge your financial health. It's a simple yet powerful tool, comparing your monthly debt payments to your gross monthly income. Understanding your DTI is the first step towards a healthier financial future.

Why It Matters:

- Loan Eligibility: A lower DTI ratio can make you more attractive to lenders, increasing your chances of loan approval.

- Financial Health Indicator: It's a snapshot of your financial standing, showing how much of your income is tied up in debt.

Navigating the Calculation

Calculating your DTI ratio isn't rocket science; it's straightforward math. Add up all your monthly debt payments—this includes mortgages, car loans, credit card payments, and any other debts. Then, divide this total by your gross monthly income (the amount you earn before taxes and other deductions). The resulting percentage is your DTI ratio.

An Example:

- Monthly Debts: Mortgage ($1,200) + Car Loan ($300) + Credit Card Payments ($400) = $1,900

- Gross Monthly Income: $5,000

- DTI Ratio: $1,900 / $5,000 = 38%

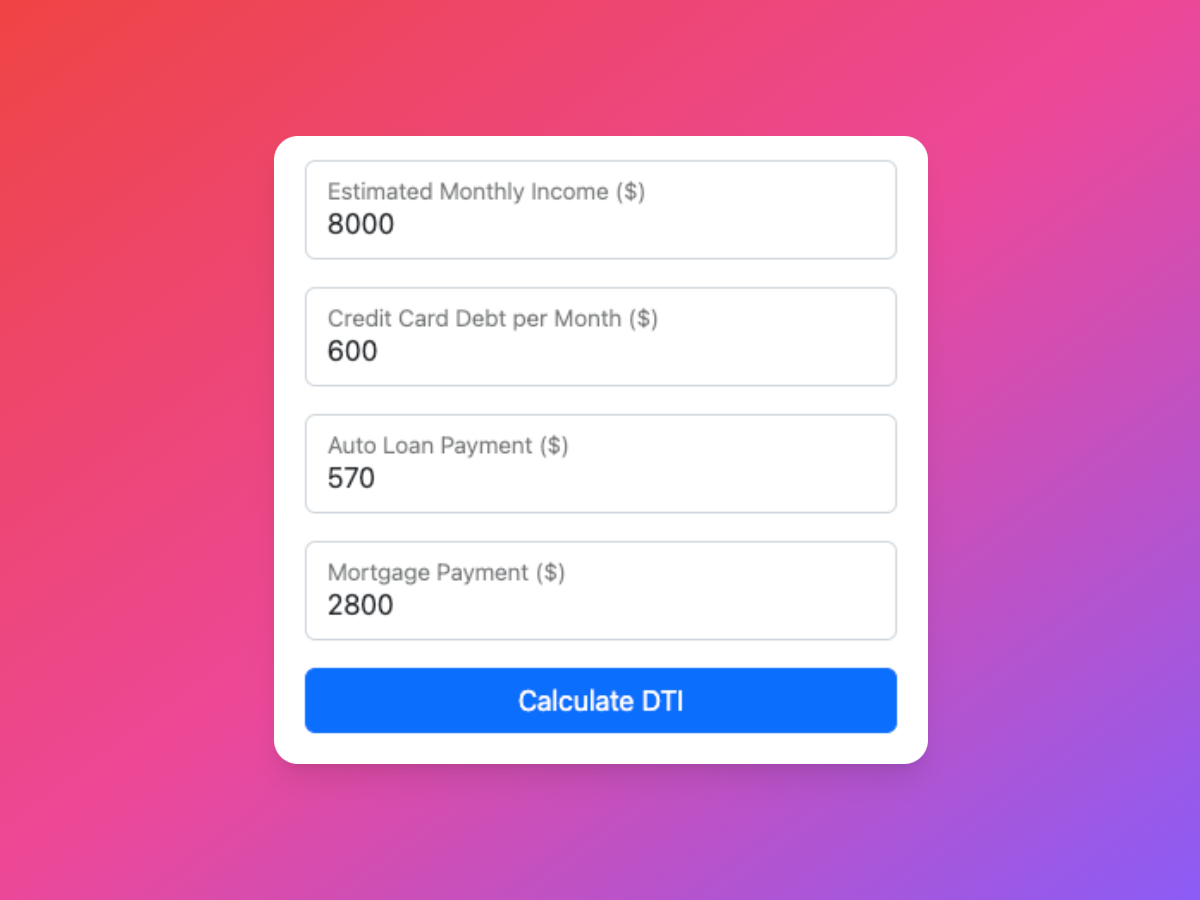

The Magic Tool: Loan Finder’s DTI Calculator

Now, here's where Loan Finder's Debt-to-Income Ratio Calculator comes into play. This intuitive tool simplifies the calculation process, offering a clear view of your DTI ratio. It's not just about crunching numbers; it's about providing insights to help you make informed financial decisions.

Dynamic Insights: Loan Finder’s Interactive DTI Calculator

The brilliance of Loan Finder's Debt-to-Income Ratio Calculator lies in its ability to not just calculate your DTI ratio but also provide real-time feedback based on your numbers. As you enter your financial details, the calculator doesn't just spit out a percentage; it gives you insights and recommendations tailored to your unique situation.

Interactive Feedback:

For instance, if your calculated DTI ratio is hovering near a critical threshold, the tool doesn't leave you hanging with just a number. Instead, it alerts you to the urgency of the situation with a message like:

"Your DTI ratio is nearing a critical threshold, and it's important to take action. We strongly recommend considering refinancing options. Our Loan Finder tool can be invaluable in this process, helping you discover lenders who are more flexible with higher DTI ratios. Refinancing can significantly ease your monthly financial burden, paving the way for a healthier financial future."

This interactive feature turns the calculator into a financial advisor, guiding you towards the next steps you can take to improve your financial health.

Tailored Recommendations:

Based on your DTI ratio, the calculator can suggest a variety of actions:

- For Higher DTI Ratios: It emphasizes the need for immediate action, suggesting refinancing as a viable option to manage high debts more effectively.

- For Moderate DTI Ratios: The tool may recommend strategies for gradual debt reduction or income enhancement to further strengthen your financial standing.

Benefits of Using the Calculator:

- User-Friendly Interface: Easy to input your financial details and get instant results.

- Accuracy: Ensures precise calculations, giving you a reliable DTI figure.

- Financial Planning: Helps in strategizing for loan applications or debt management.

Strategies for Improving Your DTI Ratio

Knowing your DTI ratio is just the beginning. The real challenge lies in improving it. Lowering your DTI ratio can enhance your loan eligibility and overall financial health.

Effective Tactics:

- Increase Income: Boosting your monthly income, through a side hustle or a higher-paying job, can lower your DTI ratio.

- Reduce Debts: Paying down high-interest debts, especially credit card balances, can significantly impact your DTI.

- Restructure Debts: Consider consolidating debts or refinancing loans to lower monthly payments.

Real-Life Scenarios and Solutions

Imagine John and Sarah, both looking to apply for a mortgage. John has a high DTI ratio due to multiple credit card debts, while Sarah’s is moderate, but she's aiming to lower it further. By using Loan Finder’s DTI Calculator, they both get a clear picture of their financial standings and adopt strategies to improve their ratios—John focuses on paying down his credit card debts, and Sarah takes on a part-time job to increase her income.

Success Stories:

- Improved Loan Terms: With a lower DTI ratio, borrowers like John and Sarah can secure loans with better interest rates and terms.

- Enhanced Financial Stability: A healthy DTI ratio leads to a more balanced financial life, reducing stress and increasing savings.

Conclusion

Mastering your debt-to-income ratio is an empowering journey. It starts with understanding this vital financial metric and using tools like Loan Finder’s DTI Calculator to keep track. But the real victory comes from adopting strategies to improve your DTI, leading to better loan options and a more secure financial future. It's not just about numbers; it's about taking control of your financial destiny.

Resources

For more information on mortgage and financial planning tools, check out the following links: